A Comprehensive Guide to Corporate Voluntary Agreement (CVA).

A Comprehensive Guide to Corporate Voluntary Agreement (CVA).

Blog Article

Ultimate Guide to Recognizing Corporate Volunteer Agreements and Just How They Benefit Businesses

Company Volunteer Agreements (CVAs) have become a critical tool for organizations looking to navigate financial obstacles and restructure their procedures. As the organization landscape continues to progress, comprehending the complexities of CVAs and how they can positively impact firms is essential for informed decision-making.

Recognizing Company Volunteer Arrangements

In the realm of company administration, a basic principle that plays a critical function fit the relationship in between business and stakeholders is the complex mechanism of Company Voluntary Arrangements. These arrangements are volunteer commitments made by companies to follow specific requirements, practices, or goals past what is legitimately called for. By becoming part of Corporate Voluntary Contracts, firms show their commitment to social duty, sustainability, and honest service methods.

Advantages of Company Volunteer Arrangements

Moving from an exploration of Business Volunteer Agreements' significance, we now turn our attention to the substantial benefits these arrangements provide to firms and their stakeholders. One of the key advantages of Business Voluntary Arrangements is the possibility for firms to restructure their financial obligations in a much more workable means.

Additionally, Corporate Voluntary Arrangements can boost the firm's online reputation and relationships with stakeholders by showing a commitment to attending to financial obstacles responsibly. Generally, Corporate Voluntary Contracts serve as a calculated tool for companies to navigate monetary hurdles while preserving their operations and connections.

Process of Carrying Out CVAs

Recognizing the process of implementing Corporate Voluntary Contracts is essential for companies looking for to browse financial difficulties properly and sustainably. The very first step in carrying out a CVA involves selecting a certified bankruptcy practitioner that will certainly function very closely with the company to evaluate its financial situation and practicality. Throughout the execution procedure, normal interaction with financial institutions and attentive monetary administration are key to the successful execution of the CVA and the company's ultimate financial healing.

Trick Considerations for Services

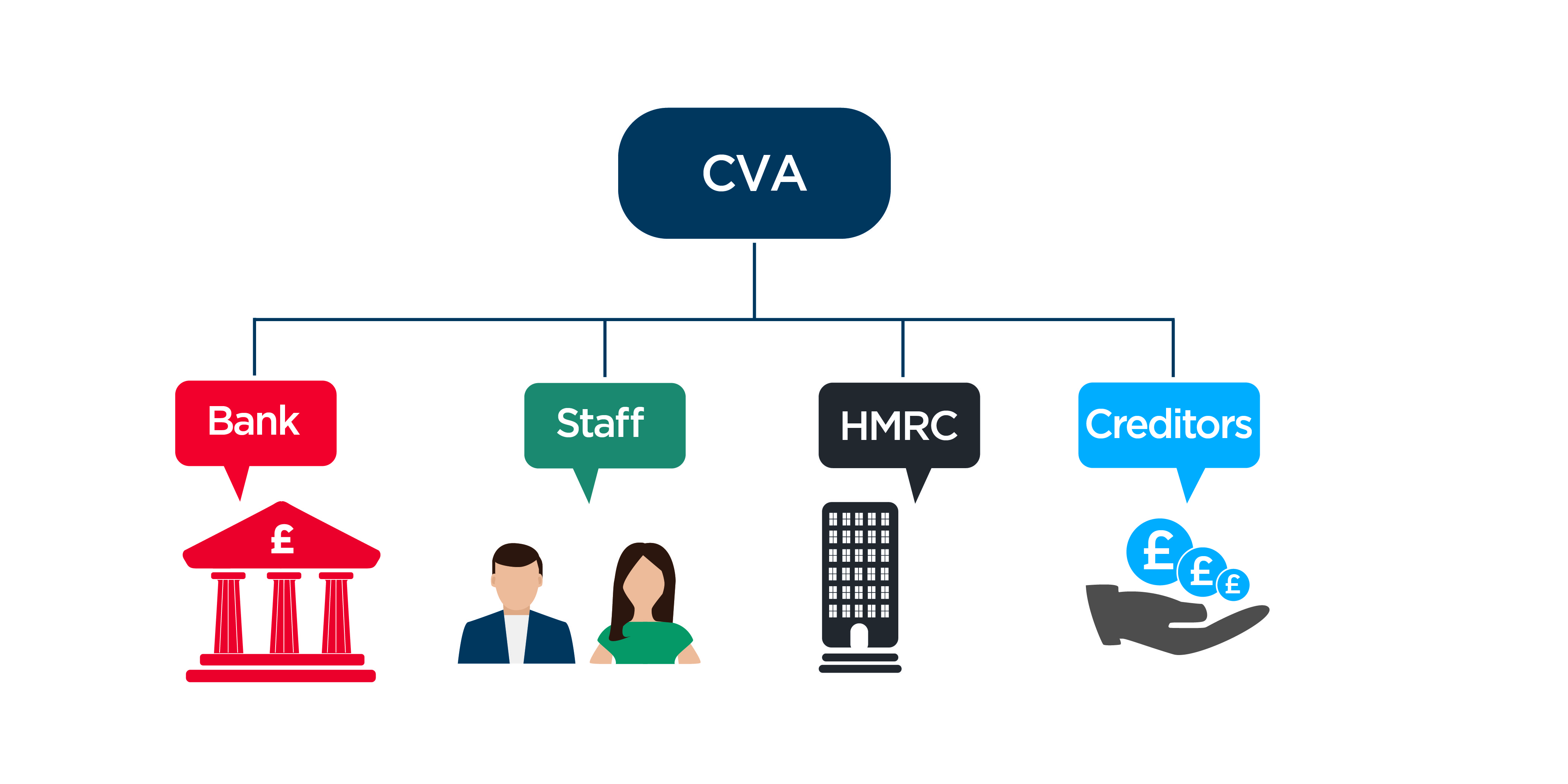

When reviewing Business Voluntary Contracts, organizations have to carefully think about key aspects to guarantee effective monetary restructuring. One important consideration is the sustainability of the recommended settlement plan. It is crucial for organizations to evaluate their capital estimates and make certain that they can satisfy the agreed-upon settlements without jeopardizing their procedures. In addition, organizations must completely assess their existing financial obligation framework and review the impact of the CVA on numerous stakeholders, including employees, vendors, and creditors.

An additional essential consideration is the level of openness and communication throughout the CVA process. Open up and straightforward communication with all stakeholders is crucial for constructing count on and guaranteeing a smooth application of the contract. Services need to also consider looking for professional advice from lawful experts or financial professionals to navigate the intricacies of the CVA process properly.

Additionally, companies require to assess the long-term implications of the CVA on their reputation and future funding possibilities. While a CVA can offer instant relief, it is important to assess exactly how it might impact partnerships with lenders and capitalists in the future. By meticulously taking into consideration these key variables, businesses can make educated choices regarding Company Volunteer Agreements and establish themselves up for a successful financial turnaround.

Success Stories of CVAs at work

A number of services have successfully implemented Company Voluntary Contracts, showcasing the performance of this financial restructuring device in rejuvenating their procedures. By entering into a CVA, Business X was able to renegotiate lease arrangements with property managers, lower overhead prices, and restructure its financial obligation obligations.

In another circumstances, Firm Y, a production Discover More Here company strained with legacy pension liabilities, utilized a CVA to rearrange its pension responsibilities and streamline its procedures. Through the CVA procedure, Business Y attained significant expense financial savings, enhanced its competitiveness, and protected long-term sustainability.

These success tales highlight exactly how Corporate Voluntary Agreements can supply struggling organizations with a sensible course towards financial healing and operational turn-around - what is a cva in business. By proactively attending to financial difficulties and restructuring responsibilities, companies can arise stronger, more dexterous, and better positioned for future development

Conclusion

In verdict, Corporate Volunteer Contracts offer organizations a structured approach to dealing with monetary difficulties and restructuring financial debts. By executing CVAs, firms can prevent insolvency, secure their possessions, and preserve relationships with creditors.

In the world of corporate governance, an essential this link principle that plays a critical role in forming the connection between business and stakeholders is the complex device of Company Volunteer Contracts. By getting in right into Corporate Volunteer Arrangements, business demonstrate their dedication read this to social responsibility, sustainability, and moral service practices.

Moving from an exploration of Corporate Volunteer Agreements' relevance, we now turn our focus to the tangible advantages these contracts supply to business and their stakeholders.Additionally, Corporate Volunteer Contracts can boost the firm's credibility and partnerships with stakeholders by showing a commitment to attending to financial difficulties sensibly.Understanding the procedure of executing Business Volunteer Arrangements is vital for firms seeking to navigate economic challenges successfully and sustainably.

Report this page